Introduction

C8 - where empowerment fuels exceptional performance

Empowering institutions, platforms, Registered Investment Advisors (RIAs), and Family Offices by providing them with access to our extensive universe of investments.

Our state-of-the-art portfolio allocation tools enable precise and strategic asset allocation, tailored to their unique objectives and risk profiles. Realising portfolios seamlessly is effortless with our streamlined execution capabilities.

We chart a course towards unparalleled success, ensuring that our clients achieve their financial goals with confidence and precision.

Our Unique Offering

Professional investors can use C8 to realise the performance of any institutional-grade investment style by directly trading the underlying assets. Uniquely, C8 provides low-cost, broker-agnostic, direct access to a wide range of financial instruments, including active and passive, tradeable indices.

Independence

C8 is not bound to large banks/institutions and thus

does not push any agenda or products onto its

customers.

Access to Global Index Providers

Investors can access market-leading providers

across the world without any restrictions.

Transparency in Investing

C8 provides visibility and control of the investment

process allowing for portfolio strategies based on

criteria important to the customer (e.g. ESG).

Multiple Asset Classes & Instrument Types

C8 has a broad range of investment solutions

covering almost all asset types. As a flexible service

provider, C8 delivers exposure through direct

indexing, fund solutions, SMAs and certificates.

End-to-end Platform

C8 offers an end-to-end solution with a

marketplace, investment process and execution

services.

Leadership Expertise

Deep financial industry expertise in C8’s senior

leadership and extensive experience in delivering

high-end financial technology solutions.

Our Advantages

One-stop investing

One-stop investing: from designing exposure to

implementing execution.

Ability to generate

The ability to generate tax alpha: tax-loss harvesting,

long-term capital gains management and capital

gains tax deferral.

Ownership

Ownership of the underlying investments -

full control and transparency.

Top class

Top-class, global execution capabilities.

Bespoke indices and strategies

Bespoke index portfolios and customisation at will.

Custodian

Fits into the investor client’s existing custodian

and broker infrastructure.

Replication

Full index replication and sparse index tracking.

Fees

No layered fees.

C8 Investment Solutions

Professional investors can use C8 to realise the performance of any institutional-grade investment style by directly trading the underlying assets. Uniquely, C8 provides low-cost, broker-agnostic, direct access to a wide range of financial instruments, including active and passive, tradeable indices.

C8 Alpha

- Active and Passive Strategies Marketplace

- Bespoke Strategies and Indices

- Wrapped Strategies and Indices in UCITS Funds, Certificates and TRS solutions

- Direct indexing

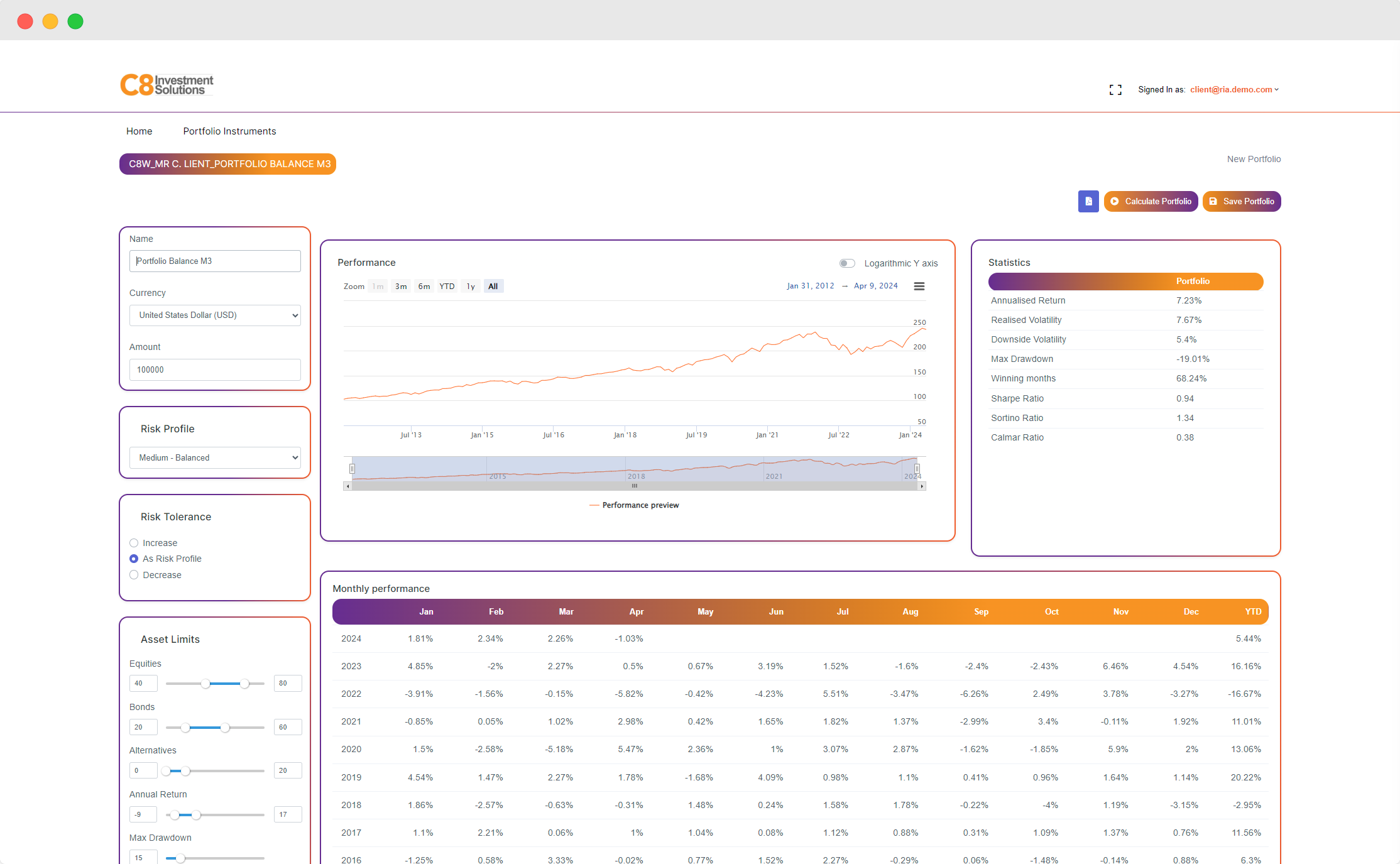

C8 Allocate

- Portfolio optimisation

- Bespoke portfolios

- Risk managed portfolios

- Tactically optimal portfolios

- Sparse portfolios

- Tracking portfolios

C8 Wealth

- Wealth platform

- Bespoke Marketplace with clients own financial products (Funds, ETFs, Certificates, …)

- Development of optimal portfolio blends

- Custom wealth solutions and reports

C8 Hedge

- Powerful, bespoke FX hedging solutions

- Advanced FX models

- Calculate optimal FX ratios

- Automates the FX risk management process

- FX research

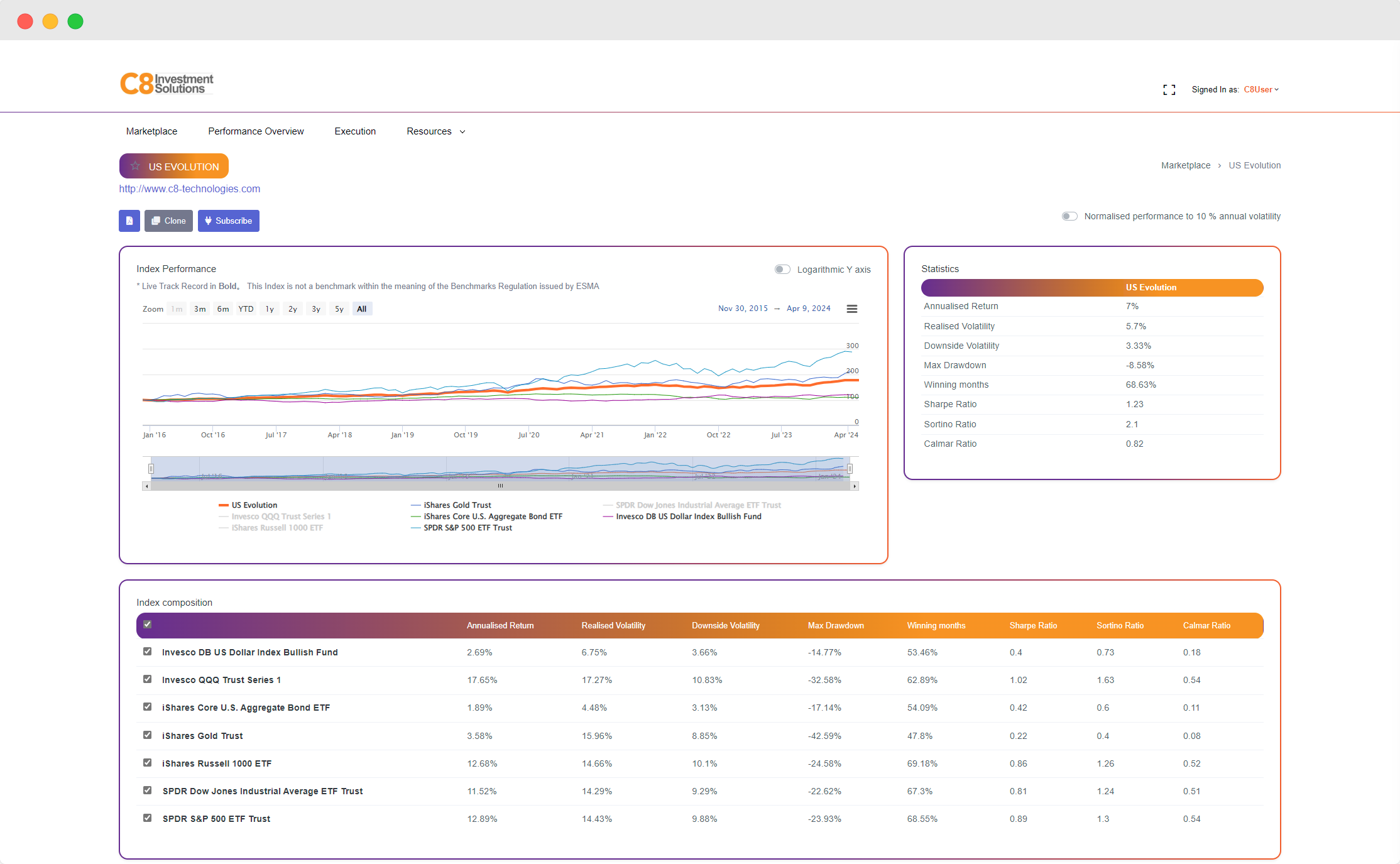

C8 Alpha

Active and Passive Strategies Marketplace

Explore our dynamic marketplace offering a diverse

array of active and passive indices and strategies.

Whether you're seeking the agility of active

management or the stability of passive indices, C8

provides a curated selection to match your

investment preferences and goals.

Direct Indexing

Seize control of your portfolio like never before with

C8's Direct Indexing platform. Say goodbye to

cookie-cutter investment solutions and hello to

direct ownership of individual stocks. With direct

indexing, you have the power to customize your

portfolio, optimize tax efficiency, and maximize

returns.

Bespoke Indices and Strategies

Tailor your investment approach to perfection with

our bespoke strategies and indices. At C8, we

understand that every investor is unique. That's why

we offer personalized solutions crafted to align

seamlessly with your financial objectives and risk

tolerance.

Tax Loss Harvesting

Maximize your tax savings with C8's tax loss

harvesting strategies. Our sophisticated algorithms

automatically identify opportunities to strategically

realize losses, offsetting gains, and minimizing your

tax liability. With C8, you can keep more of your

hard-earned money working for you.

C8 Allocate

Assessing and designing an investment portfolio in an uncertain world requires a resilient and well-thought-out approach. Diversification benefits are enhanced if the portfolio builder can harness high-performing portfolio constituents.

Bespoke Portfolios

Experience the power of customization with C8's

bespoke portfolios. We understand that no two

investors are alike, which is why we tailor each

portfolio to reflect your individual aspirations and

risk appetite.

Combination Strategies

Explore a diverse range of investment strategies with

C8's combination approach. Whether you're seeking

growth, income, or a balanced combination of both,

our platform provides the flexibility to create a

portfolio that suits your needs.

Portfolio Optimization

Unlock the full potential of your investments with

C8's portfolio optimization tools. Our sophisticated

algorithms continuously analyze and adjust your

portfolio to maximize returns while managing risk

effectively.

Analysis and Research

Make informed decisions with C8's comprehensive

analysis and research resources. From in-depth

market insights to individual stock analysis, our

platform equips you with the tools you need to stay

ahead of the curve.

Assessing and designing an investment portfolio in an uncertain world requires a resilient and well thought out approach. Diversification benefits are enhanced if the portfolio builder can harness high performing portfolio constituents.

Explore the impact of our systematic portfolio construction process or read the short whitepaper.

We have chosen a US Balanced Equity and Bond index as the benchmark for simplicity and clarity. The choice of benchmark can be very important and the most appropriate benchmark is frequently unique to a client. A full allocation to equities is likely to be incompatible with a well-balanced portfolio so be mindful of volatility and drawdowns when comparing the annualised performance below.

Portfolio Performance -

Statistics

| Benchmark | Allocation | |

|---|---|---|

| Annualised Return | 6.51 | |

| Realised Volatility | 8.81 | |

| Downside Volatility | 6.25 | |

| Max Drawdown | -20.28 | |

| Winning Months | 67.65 | |

| Sharpe Ratio | 0.74 | |

| Sortino Ratio | 1.04 | |

| Calmar Ratio | 0.32 |

Sample Asset Mix Table

C8 Wealth

Bespoke Marketplace with Proprietary Products

Discover exclusive investment opportunities within

our bespoke marketplace, featuring clients'

proprietary products. Whether you're seeking

innovative Funds, cutting-edge ETFs, or specialized

Certificates, C8 provides access to unique offerings

tailored to your investment objectives.

Custom Wealth Solutions

Experience unparalleled customization with C8's

custom wealth solutions. From retirement planning

to estate management, our platform offers tailored

solutions to address your specific needs and

objectives.

Development of Optimal Portfolio Blends

Craft the perfect blend of assets with C8's portfolio

optimization tools. Our platform analyzes your

financial goals, risk tolerance, and market conditions

to develop optimal portfolio blends that maximize

returns and minimize risk.

Comprehensive Reports

Stay informed and empowered with C8's

comprehensive reporting capabilities. Access detailed

insights into your portfolio performance, asset

allocation, and investment strategy through

customizable reports tailored to your preferences.

C8 Hedge

Powerful Bespoke FX Hedging Solutions

Say goodbye to one-size-fits-all approaches and

hello to tailor-made FX hedging solutions. C8 offers

bespoke strategies designed to address your unique

FX exposure, ensuring optimal risk management and

protection against currency volatility.

Calculate Optimal FX Ratios

Unlock the full potential of your FX hedging strategy

with C8's ability to calculate optimal FX ratios. Our

platform analyzes economic and market data and your specific risk

profile to determine the ideal balance of hedged and

unhedged positions, maximizing efficiency and

minimizing costs.

Advanced FX Models

Leverage the latest advancements in FX modelling

with C8. Our platform incorporates sophisticated

algorithms and predictive analytics to forecast

currency movements accurately, enabling proactive

decision-making and strategic hedging.

Automated FX Risk Management Process

Streamline your FX risk management with C8's

automated solutions. Our platform automates key

processes, from risk assessment to hedging

execution, saving you time and reducing manual

errors, so you can focus on growing your business

with confidence.

Please test the C8 Hedge for USD, EUR and GBP, updated until {{chartsUntilDateText}}, with the demo below.

To learn more, please request an Account.

KnowledgeHub

MI2: Whither US Treasuries?

Thoughts From The Divide: The Moon

Thoughts From The Divide: Particularly Fluid

Thoughts From The Divide: Strength in Numbers

FX Hedging Active or Passive

Thoughts From The Divide: Regrets

Thoughts From the Divide: Attribution

Thoughts From the Divide: Avoiding the Inverse

C8 Hedge on The Full FX

Thoughts From the Divide: Tremendous

MI2 for C8 – The FX Year Ahead – Turning Japanese – Feb 2024

Thoughts From The Divide: Hold On Tight

Thoughts From The Divide: A Question of Confidence

Thoughts From the Divide: Subject to Change

Thoughts From the Divide: The First Cut

Thoughts From The Divide: Signs of Life

Thoughts From The Divide: Danger to Itself

Thoughts From The Divide: Identifying Ducks

Thoughts From the Divide: Lessons Learned

Thoughts From The Divide: Adjustments

News and Updates

C8 Technologies adds Thor Financial Technologies to it’s Direct Indexing and UMA Studio

Introducing Trendrating Direct Indices Through C8

C8 Technologies Expands into the US with New Tools and Team

C8 Announces new Credit Suisse Active World ESG Certificate

Ned Davis Conference

Chinese online conference with over 4000 attendees

ESG and the power of direct indexing

How Blockchain Will Disrupt, Add Value For Wealth Managers

C8 Technologies expands into Spain with two new hires

C8 announces Diversified Risk Premia Index

C8 Technologies and Green Blue Invest combine to create the first Good Governance US Equity L/S Index

New Year – New Branding – New Websites

C8 Announces Diversified Risk Premia Index

NDR -Advantages of Direct Indexing and a Dynamic Allocation Strategy

C8 Letter in the FT

C8 Technologies

C8 Technologies was established in 2017 in London by Mattias Eriksson and Ebrahim Kasenally , previously partners and senior executives at BlueCrest Capital Management – one of the largest global alternative investment management firms. C8 combines decades of investment research, trading and technology experience.

C8 Technologies is a fintech company that has developed a global platform where customers have access to a marketplace with strategies and can trade underlying assets directly via their own broker.

Mattias Eriksson

Founder & CEO

Ebrahim Kasenally

Founder & Chief Research Officer

Contact Us

Please contact us with your thoughts and needs. We like nothing more than to work with you to create customised, efficient strategies that you then control and implement.

184-186 Regent Street

London

W1B 5TW

477 Madison Avenue

New York,

NY10022

Rooms 1101A-4

China Evergrande Centre

38 Gloucester Road

HK

Room 3AN204F

Kerry Parkside

1155 FangDian Road

Pudong District

China

Lee View House

13 South Terrace

Cork

Ireland

Via Olona 12

20123 Milan

Italy

C/ Matias Turrión 24 Bis 1º

28043 Madrid

Spain