“Ensure inflation is… wooden-stake-in-the-heart dead”

For those of us who regularly follow the “wonksphere” on social media, it’s been hard to ignore the pushback against the doom and gloom that economic sentiment surveys have consistently reported. Commentators like Stancil and Sahm have bitterly complained about the disconnect between the public’s negative perceptions relative to the hard economic data, which is ostensibly pretty good. In this, they have been carrying water for policymakers like Lael Brainard, who have attempted to burnish the Administration’s economic achievements to push back against the negative perception of the economy. The most obvious of those achievements is the decline in inflation – see, we told you it was transitory!

Brits reading this might think they recognise the “You’ve never had it so good” from Macmillan, but it is actually an Adlai Stevenson quote (which garnered this response from the Eisenhower campaign). Sadly, neither of these precedents will cheer up Democrats. What’s more, this communication strategy is not without its risks. Markets have now priced 165bps of rate cuts over the next 12 months, but a number of Fed speakers linked rate cuts with further progress on inflation, not to mention wider economic and financial conditions. Even Brainard chose not to declare total victory on a recent podcast appearance. A neutral observer could reasonably conclude that the “adjustment cuts” discussed by Waller and friends might drift further away on the horizon if inflation remains stubbornly strong and prevents the current level of Fed funds from becoming “mechanical[ly]” tight. Of course, in election years, it can be hard to find neutral observers. And if you were looking for one, you probably wouldn’t start in the Eccles Building.

As to the causes of the tailwinds, Axios noted in its breakdown of the numbers that” rebounding energy costs and high housing costs helped push up overall inflation”. To the latter, we would point to the recent positive news from Redfin about increased mortgage applications and an uptick in requests for tours (though the fine print is a number of metrics saw their smallest year-over-year decline in a number of years, which is perhaps not a cause for celebration, but progress nonetheless). Though, the Council of Economic Advisers argues that “housing inflation is slowly easing” (as evidenced by their model, whose adjustment some took issue with). Ed. Up with which, I will not put! To the former, there may be more to energy prices than meets the eye. As noted by Tracy Shuchart on Twitter, thanks to the, uh…. issues in the Red Sea, “surging tanker rates close the door on US crude oil shipments to Asia”, meaning that the “surprise” storage build may not be a one-off and potentially lead to an improvement in the “weekly budget and… kitchen table economics” that Lael Brainard discussed in her interview. This does come with a very heavy counterpart in the form of potentially significant increases in import prices somewhere down the line. Maersk “warned it could take months to reopen the crucial Red Sea trading route, risking an economic and inflationary hit to the global economy, companies and consumers”. Oh, and the company is now also needing to find workarounds for the Panama Canal as well?

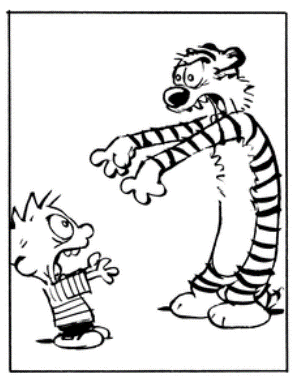

With echoes of what ostensibly drove inflation back when Covid was around (which Brainard pointed out was a double whammy as it allowed companies to increase their markups in a “price-price spiral”), is there a chance that inflation is back from the dead and that the Fed will still opt for cuts? Don’t hold your breath, says Harley Bassman (the Convexity Maven). In a note from December, Bassman wrote that Powell’s main concern is “the epitaph that will be chiseled onto his tombstone” and “Chairman Powell is not cutting rates until he has driven a wooden stake into the heart of inflation to secure his legacy”. This latter thought was then repeated in the same podcast on which Brainard spoke. We have a healthy respect for Mr. Bassman’s thoughts, but perhaps he is unaware of the risks posed to Democracy by one of the candidates. As it happens, PCE inflation surprised the downside, allowing the market to forget the slight inflation disappointment of the day before. But the recent bombing of Yemen is unlikely to fix the problems with shipping costs any time soon.

In the meantime, Powell is, of course, contending with powerful forces perhaps beyond his own reckoning. The US is currently on pace to end 2024 “with a deficit of just more than $2 trillion”. But that is a(n inflation horror) story for another day. It’s hard to imagine a significant slowing of the real economy with the current level of fiscal stimulus. But maybe that’s just a failure of imagination on our part.

P.S. Don’t count out wage-price!